Mark H. Smith, Inc. recently conducted a survey on CECL readiness and planning among its clients. Based on the survey, most credit unions were aware of CECL and have given it some thought or began planning for CECL implementation. However, most of the credit unions that responded to the survey had not yet taken action steps such as ensuring that the necessary data was being warehoused.

One of our objectives in conducting the survey was to provide credit unions with some insight as to where their peers may be in the CECL planning and development process. In addition to their progress, we also queried how they were going to implement CECL. For example, are they going to make modifications to their existing ALLL process, develop a completely new CECL process in-house, or look at obtaining an outsourced vendor solution.

The CECL survey answers to these questions and others are as follows:

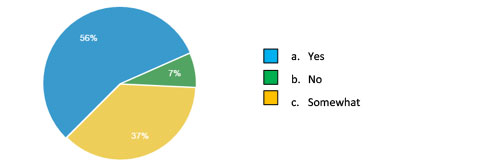

The first question asked was simply whether the credit union was aware of the new upcoming CECL (Current Expected Credit Loss) compliance requirements?

The results came back with 56% saying yes and another 37% saying somewhat.

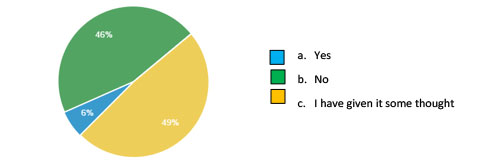

The second question asked if the credit union had a CECL plan and if they had determined what data they would need for CECL modeling?

Only 6% answered yes and 49% have given it some thought.

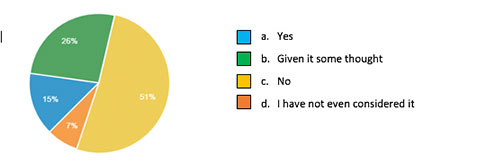

Following up, question 3 asks if the credit union has begun warehousing the data needed for the expected loss modeling?

51% answered no, 15% had started, and 26% had given it some thought.

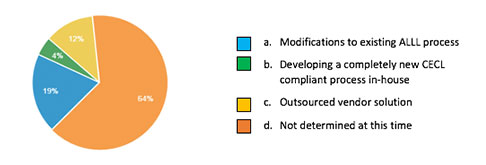

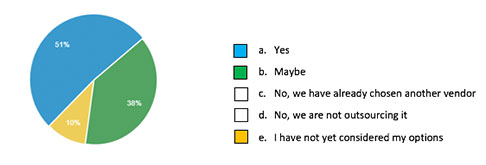

Question 4 asks about how the credit union is planning on implementing CECL?

64% of credit unions had not determined at this time how they were going to implement CECL. Another 19% were planning on modifying their existing program along with 12% using an outsourced vendor solution.

When asked if the credit union would consider utilizing an outsourced CECL solution from Mark H. Smith, Inc. in question 5 —

51% percent answered yes with another 38% who responded with a maybe.

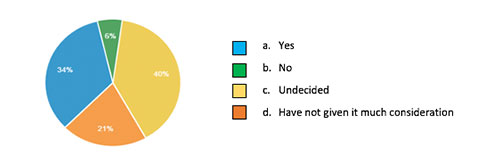

Given the potential for a higher loss provision with the new rule, question 6 asked if they are planning on running a parallel CECL model for comparison to their current ALLL methodology before adoption?

34% of credit unions answered yes with another 40% still undecided.

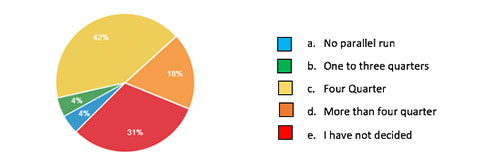

Continuing from question 6, question 7 asks how long of a parallel run would be appropriate for planning prior to converting to CECL?

42% of credit unions said they would do a parallel run for four quarters with 31% answering they had not decided on a time yet.

If you have not begun considering these questions, don’t worry! There is still time to begin the planning and development process, but it should be somewhere on your horizon. Specifically, the credit union needs to take account of what the data requirements may involve for their potential CECL process and ensure that information is being captured and warehoused.

See CECL and Comprehensive Loan Analytics Survey Results Here (Sept 2017)