BY MATTHEW JACOBSEN

The Federal Funds rate has now been increasing since December of 2015. The current Federal Funds target rate is 1.75% at the time of this writing. The U.S. Treasury curve three-month to five-year terms have also been increasing during this time period. The two-year U.S. Treasury Yield has gone from 1.08% at the end of 2015 to 2.44% as of this writing. However, during this time period, many consumer loan rates have lagged these increases as competitive pressures remained in lending markets and liquidity was still plentiful. Nonetheless, 2017 and the first quarter of 2018 did see new origination loan rates begin to move higher, and some expect this pace to quicken. In addition, most member deposit balances also did not see much pressure to increase rates since December of 2015, but this also began to change for member CDs in 2017 and also may be accelerating.

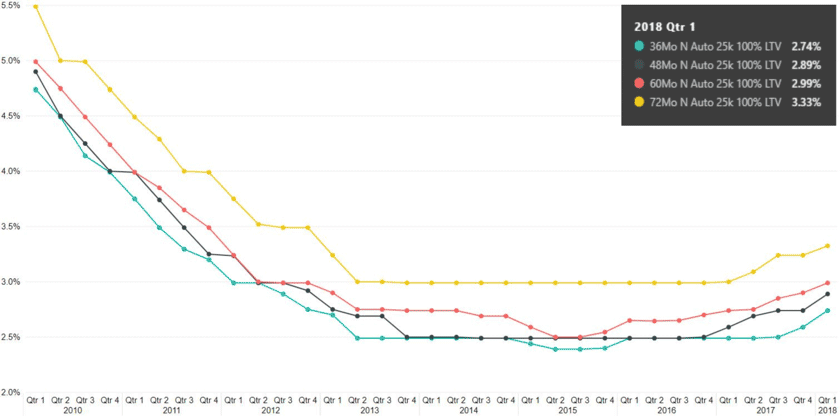

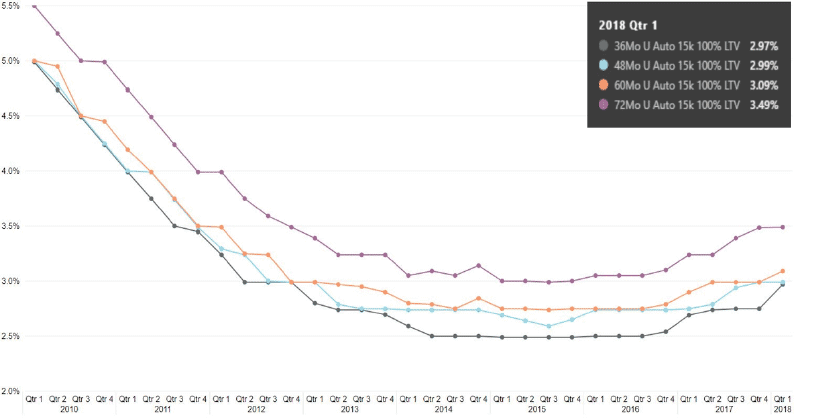

As can be seen with the new and used auto loan rates graphs below, new origination auto loan rates began increasing in 2017 and have continued upwards in the first quarter of 2018. As the Federal Funds target rate and short-end of the U.S. Treasury yield curve is currently expected to continue rising, many expect the trends seen in these graphs to continue and possibly even accelerate as they catch up to the Federal Funds target rate and U.S. Treasury yield curve. Credit unions need to consider this possibility when setting loan rates and particularly when setting rates for fixed-rate loans where these rates may be in two to three years. This becomes the case even more so for longer fixed-rate loan types as the credit union needs to consider the margin impact not just today, but over the next several years. Where should you be setting rates today, for your net interest margin objectives over the next several years?

Median New Auto Loan Rates

MHSI Interactive Peer Analysis

Median Used Auto Loan Rates

MHSI Interactive Peer Analysis

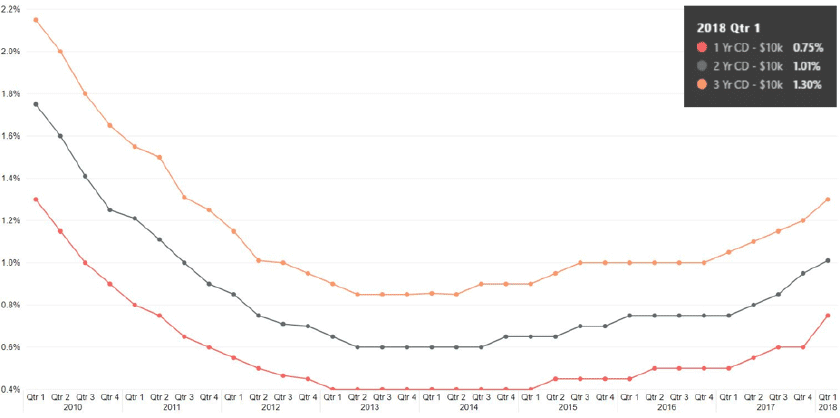

Since December of 2015, member non-maturity share rates have still not seen much pressure to increase for many credit unions. Some have argued that notable increases to member non-maturity share rates are still off in the distance. This may or may not be the case, but some credit unions have started to see pressure from larger balance member deposits, particularly in higher balance money market tiers. In terms of non-maturity share rates, this is where we would expect to see the initial pressure upwards (i.e. the larger, more rate sensitive balances). Member CD rates definitely began to increase in 2017 and at least based on the recent quarter, may be accelerating (see the Member CD Rates graph below).

Median Member CD Rates

MHSI Interactive Peer Analysis

Given the rising interest rate environment and an assessment of current and potential future movements on both the interest-bearing asset and interest-bearing liability sides of the balance sheet, now is the time to sharpen your focus on the credit union’s net interest margin objectives and risks. More specifically, this should include an assessment of where these rates may be within the next few years relative to the credit union’s net interest margin objectives. What if non-maturity member deposit rates start seeing greater upward pressures within the next year? Is the credit union considering this possibility when setting interest rates for five to seven-year fixed rate auto terms? In addition to the above, the credit union should also be considering potential increases to loan loss provisioning if the credit cycle turns as well as the impact of CECL for net interest margin planning and monitoring over the next several years.

As described above, the current bias is for higher benchmark interest rates, loan rates, and certain member deposit rates. It certainly makes sense to have a bias towards this outlook in managing the credit union’s current and forecasted net interest margin. However, as we often like to do at Mark H. Smith, Inc., “what-if” the current bias upwards in rates does not get much higher and even reverses course? Is there really any likelihood of this scenario on the horizon? Maybe or maybe not, but we continue to monitor the flattening of the U.S. Treasury yield curve as the spread between 2s and 10s is still at its tightest since the 2008 recession. If the economy is so strong and with inflation at 2.5% and potentially rising, why are 10-year bonds only yielding about .50% above inflation? Is the longer end of the U.S. Treasury bond market telling a different story than solid economic growth and increasing inflation, or is this still the remnants of quantitative easing across the globe holding longer-term rates down? A planning bias for higher interest rates is certainly a good base case in the current environment, but as risk managers, we are always on the lookout for potential market tells that may oppose the consensus. Either way, the current interest rate environment certainly demands a sharp focus on current and future loan and deposit rates and minding the margin.