By Cynthia Walker, CEO

It was a long time coming.

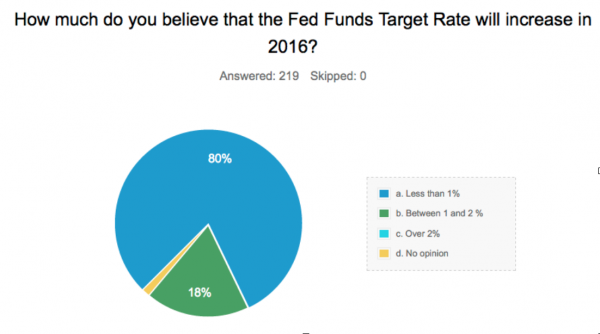

Following seven years of near-zero rates, the Federal Open Market Committee raised the Fed Funds target rate to a range of 0.25 to 0.5% based on the “reasonable confidence that inflation will rise, over the medium term, to the Fed’s 2% objective.” How this plays out over the next couple of years remains to be seen.

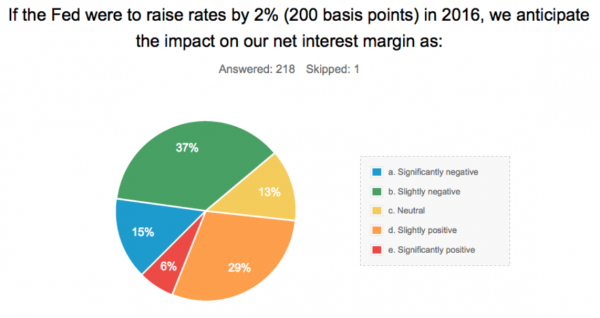

Many of our readers have not experienced multiple or significant rate cycles over their professional tenures… while others have been down this road before. This has been a seven-year struggle for credit unions. Although credit union membership is growing (about 5% annually), there are 185 fewer U.S. credit unions than there were a year ago1. Financial institutions’ spreads have remained sparse to non-existent for a protracted period of time, and a rise in short-term rates may be welcomed.

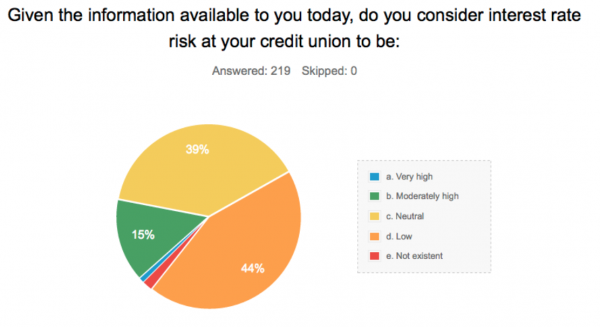

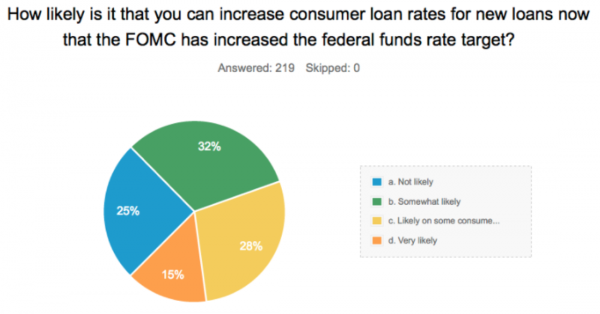

It is always wise to understand your credit union’s interest rate risk and prepare and strategize on how the credit union may respond for both loan and deposit rates if and when rates move up further. We also caution you to be prepared to manage earnings in the event that rates do not change significantly. The Federal Reserve press release also noted, “some survey-based measures of longer-term inflation expectations have edged down” recognizing the possibility that future rate hikes may not materialize. At the same time credit union regulators are hyper focused on interest rate risk, often at the expense of realistic balance sheet structures that would help strengthen earnings in this lower rate environment.

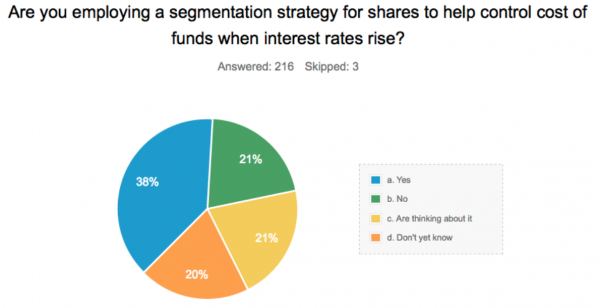

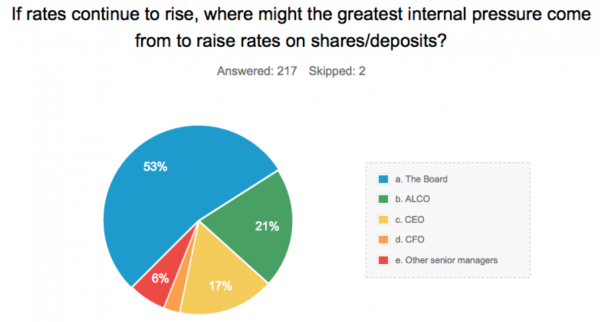

Following the Fed’s announcement on December 16th we undertook a quick survey to ask: “How will the recent FOMC action impact your credit union?” At Mark H. Smith, Inc. we feel increasing rates by the FOMC over the next 12 to 24 months is not as clear cut as one would hope, and based on the survey, many of you feel the same way. The survey2, 3 results are presented below and provide some useful insight into what your contemporaries are thinking as we enter 2016.

1. CUNA E&S, Third Quarter, 2015

2. Survey of reaction to rising interest rates, 219 U.S. credit unions conducted by Mark H. Smith, Inc.

3. ©2015 Mark H. Smith, Inc. All rights reserved.