BY JEFFREY JOHNSON

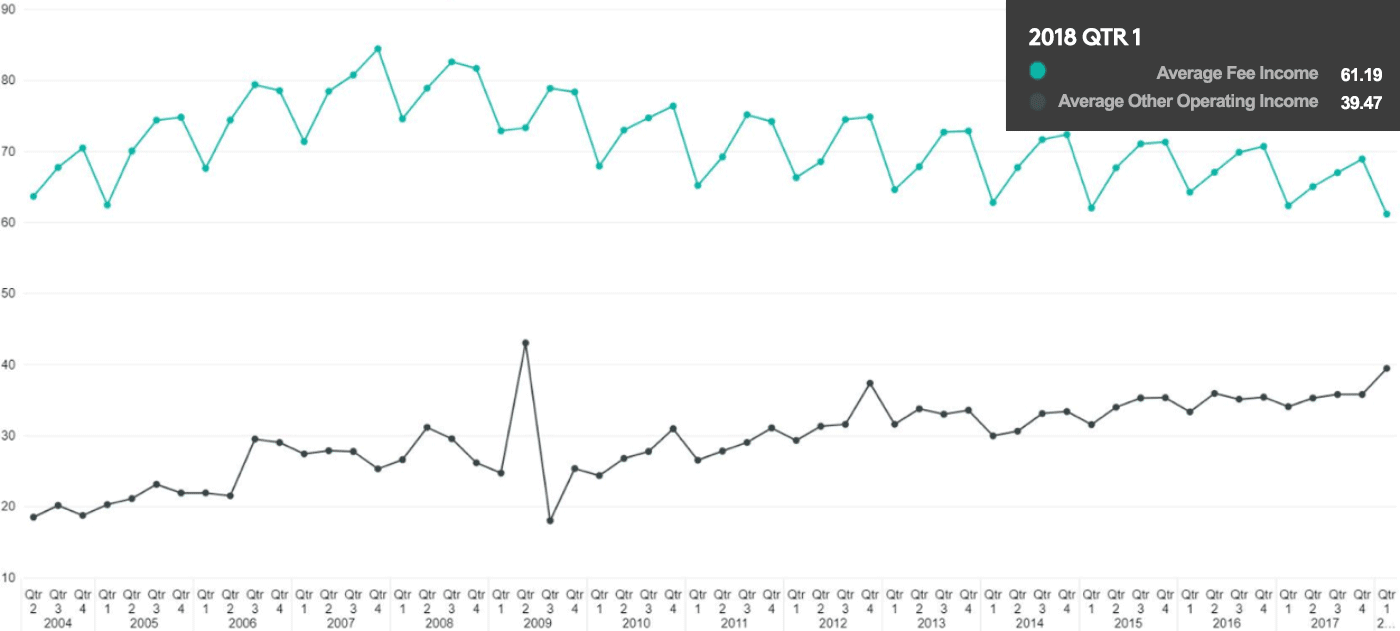

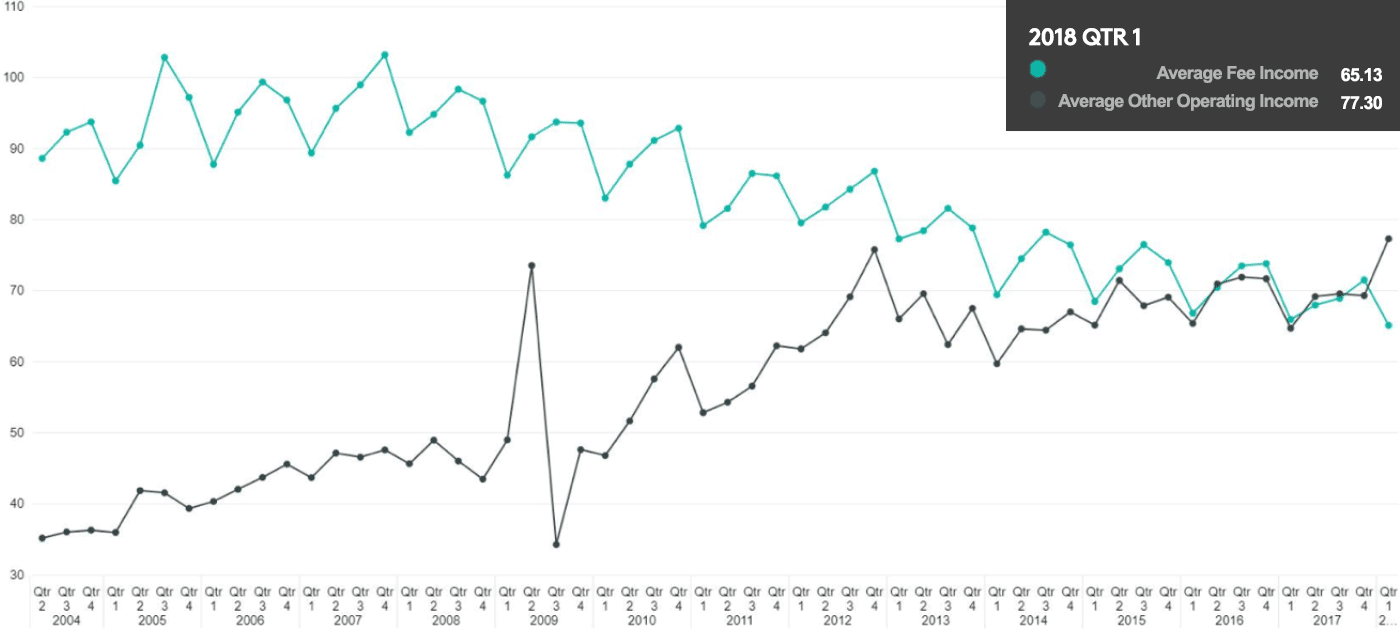

Average fee and other operating income were both increasing leading up to the financial crisis. However, since the financial crisis, fee income has been steadily decreasing and other operating income has been increasing. The increase in other operating income has just about offset the decrease in fee income. This trend becomes more pronounced as the asset size of credit unions increases (see graphs below). What do these changes in income mean going forward?

Average Annualized Fee and Other Operating Income (% of Avg Assets in Basis Points)

All Credit Unions

MHSI Interactive Peer Analysis

Average Annualized Fee and Other Operating Income (% of Avg Assets in Basis Points)

Credit Unions > $500 Million in Assets

MHSI Interactive Peer Analysis

Fee income is described in the NCUA 5300 Call Report Instructions as “Fees charged for services (i.e., overdraft fees, ATM fees, credit card fees, etc.).” Fee income must be directly from the credit union members—while other operating income is from third-parties. Common other operating income items are income derived from selling real estate loans on the secondary market and interchange income.

As net interest margins have been squeezed the past 10 years, many credit unions have relied on fee and other operating income to keep their ROA positive. But rather than put that strain on their members, credit union managers have been looking to revenue sources other than their members directly.

Lowering fee income can be a great benefit to members. It does, however, come with a risk to the financial stability of the credit union. Currently, credit unions have been able to offset the fee income with other operating income. While continually seeking other sources of income to ultimately benefit members is prudent and proper management of the credit union, reliance on any particular source can be problematic. For instance, a lot of credit unions have increased selling real estate loans on the secondary market. If the market for real estate loans changes, then there can be consequences not only to the loan portfolio, but also to other operating income. If fee income has been allowed to drop due to the increase in other operating income, then this downturn in income could spell trouble.

Fee income can have a negative stigma, but for many members the services that go along with the fees far outweigh the costs. For example, offering the underserved better service and pricing for payday loan type services can be a win for everybody, but particularly the member in need of this service. Finding the right balance in fee income can be tricky and takes much more individual thought and approach. For almost all credit unions, fee income is an essential pillar to financial viability and in turn the ability to provide the services that all members need. The consequences of a continually decreasing fee income should be defined and measured along with follow-up on possible adjustments to undesired trends.

Just as credit unions should monitor concentration risk and diversify loan and investment portfolios, monitoring and diversifying fee and other operating income is also essential—especially if it is being relied upon for a positive ROA. It is important to look at the sources of fee and other operating income and identify potential concentration risks. This process can also help identify areas of new income potential or a need to review fee structure. Credit union management should be aware of the risks that come with lowering fee income and look for a diversified fee and other operating income structure that will support the credit union’s financial stability.